Grow your UK property portfolio from scratch with expert tips, creative strategies and free online buy-to-let training.

Read More

Investing in property can be a great way to build wealth and generate passive income over time. However, financing your investments can be a daunting task, especially for new investors. With a variety of financing options and considerations to keep in mind, it’s important to educate yourself before making any significant investment. In this blog post, we’ll discuss some of the most popular financing options available to property investors, share some tips for managing your investments, and offer some key considerations to keep in mind before taking the plunge.

Table of Contents

ToggleWhen it comes to financing your property investments, there are several popular options to consider. One of the most common is taking out a mortgage loan. Mortgage loans allow you to borrow money from a lender to purchase a property, with the possibility of earning a return on your investment over time. Another option is to use equity in other properties you own to secure a loan for a new investment. You may also consider a hard money loan, which provides short-term financing for real estate investments, but often comes with higher interest rates and fees. Finally, you might consider working with a private lender, who can offer financing options outside of traditional banks or financial institutions.

Once you’ve secured financing and made your investment, it’s important to manage your properties effectively to ensure they generate the maximum return on investment. One key consideration is your rental income. Ensure your rental rates are competitive with the market, and consider investing in upgrades or renovations to improve the value of your property in the long run. Marketing your property effectively is also important, as this can help you attract quality tenants and keep your units occupied. Finally, always maintain a reserve fund to cover unexpected expenses, like repairs or unexpected vacancies.

Before investing in any property, there are several important considerations to keep in mind. One key factor is your personal financial situation. Ensure you have enough savings or income to cover potential expenses, and never invest more than you can afford to lose. Another consideration is the location and condition of the property itself. Research market trends to determine whether the property is likely to appreciate in value over time, and consider any ongoing maintenance or repair costs. Finally, stay up to date on legal considerations to ensure you’re operating within the law and protecting your investment in the long run.

With so many factors to consider when investing in property, it’s important to keep a few key tips in mind as you move forward. First, always research your options thoroughly and seek advice from experienced investors or financial professionals as needed. Second, don’t rush into any investment without careful consideration and evaluation. Finally, leverage the resources available to you, like online investment forums or local real estate associations, to build your network and establish a support system for your investments over time.

Investing in property can be a highly rewarding way to build wealth over time. However, it’s important to understand the many financing options available to you, manage your investments effectively, and keep key considerations in mind as you move forward. By doing your research, staying up to date on industry trends, and seeking advice and support when needed, you can build a successful portfolio of real estate investments that generate long-term profits and financial stability.

If you’re unsure of what to look for when visiting properties, click here to get your own FREE checklist!

Grow your UK property portfolio from scratch with expert tips, creative strategies and free online buy-to-let training.

Read MoreLearn property investment from UK experts with Assets For Life. Free courses, mentorship, and proven wealth-building strategies.

Read MoreDiscover the best ways to find rent-to-rent properties in the UK, from online portals to landlord networks and key investment tips.

Read MoreLearn how to invest in property with our beginner’s guide. Discover key strategies, finance options & mistakes to avoid.

Read More

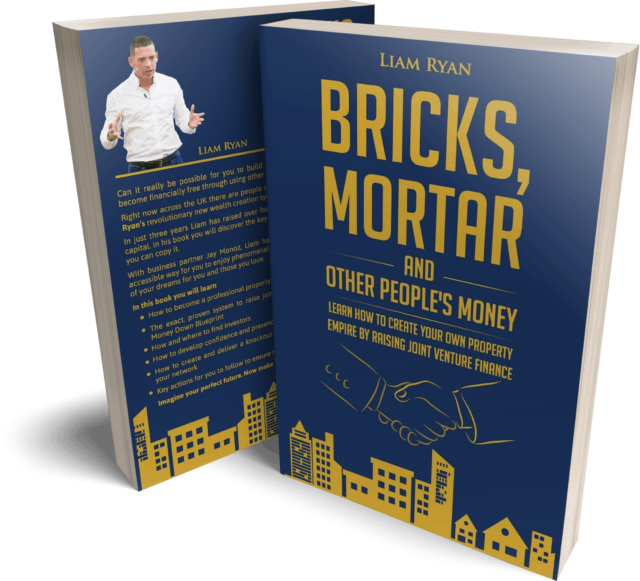

Claim Your Free Copy

Assets For Life LTD is a company incorporated in England and Wales with registered number 09935286 and registered offices at Assets for Life Ltd, Suite 105, Waterhouse Business Centre, 2 Cromar Way, Chelmsford, Essex, England, CM1 2QE, United Kingdom.

Assets For Life LTD is registered with the Information Commissioner’s Office, with registration number ZA280607

COPYRIGHT © 2024 ASSETS FOR LIFE, ALL RIGHTS RESERVED. WEBSITE BY AMPLIFY MARKETING