Thinking of selling your buy-to-let? Learn how to time the market, manage tax and maximise equity with expert landlord advice.

Read More

If you’re an investor looking for new ways to invest your money, you’ve probably come across the concept of property crowdfunding. Essentially, property crowdfunding is a way for individuals to invest in property without having to purchase an entire property themselves. Instead, they pool their money with others to buy a property, and then share in the profits when the property is sold or rented. In this blog post, we’ll explore the world of property crowdfunding and why it might be worth considering as an investment option.

Table of Contents

ToggleIn property crowdfunding, investors put in money to buy a single property or a portfolio of properties. The platform running the campaign then manages the property on behalf of the investors, handling everything from rental income to maintenance. The income generated by the property is shared among the investors, either in the form of regular rental income or a one-time payment when the property is sold. Property crowdfunding platforms typically charge a fee for their services, which can vary depending on the platform.

One of the biggest benefits of property crowdfunding is that it allows investors to diversify their portfolios. By pooling their money with others, investors can invest in a variety of properties in different locations, reducing their risk. Additionally, property crowdfunding is typically more accessible to small investors than traditional real estate investments, which require significant amounts of capital. Finally, investing in property crowdfunding doesn’t require the same level of commitment as buying an entire property, as investors can sell their shares or withdraw their funds at any time.

Like any investment, property crowdfunding comes with risks. Investors may face a lack of liquidity, as there may not be a market for their shares if they need to sell them quickly. Additionally, property values may go down, which could eat into the value of investors’ shares. There is also the risk that the platform managing the crowdfunding campaign could fail, leaving investors with little recourse. Finally, property crowdfunding platforms may be subject to regulation and licensing requirements, which can vary by jurisdiction.

If you’re considering investing in property crowdfunding, it’s important to choose the right platform. Look for platforms that are registered with relevant authorities, and that have a track record of successful campaigns. You should also consider the fees charged by each platform, and the types of properties that are available for investment. Finally, read reviews and testimonials from other investors to get an idea of how the platform operates.

Whether or not property crowdfunding is right for you ultimately depends on your investment goals and risk tolerance. If you’re looking for a way to diversify your portfolio and potentially earn passive income, property crowdfunding might be worth considering. However, it’s important to do your research, understand the risks involved, and choose a platform that aligns with your investment goals.

Property crowdfunding is a relatively new investment option that allows individuals to invest in real estate without having to purchase an entire property. While there are risks involved, property crowdfunding also offers the potential for diversification, passive income, and accessibility. If you’re interested in property crowdfunding, be sure to choose a reputable platform and do your research before investing. As with any investment, it’s important to understand the risks and make an informed decision based on your individual circumstances.

Do you want to overcome challenges, embrace opportunities and thrive in business? If yes, click here to get your FREE guide!

Thinking of selling your buy-to-let? Learn how to time the market, manage tax and maximise equity with expert landlord advice.

Read MoreDiscover UK planning permission loopholes, permitted development rights and when you can extend, convert or renovate without consent.

Read MoreLearn what the Bank of England base rate is, how it’s set, and how changes can impact buy-to-let mortgages and property investors.

Read MoreGuide to understanding the HHSRS and why it matters for landlords and property professionals.

Read More

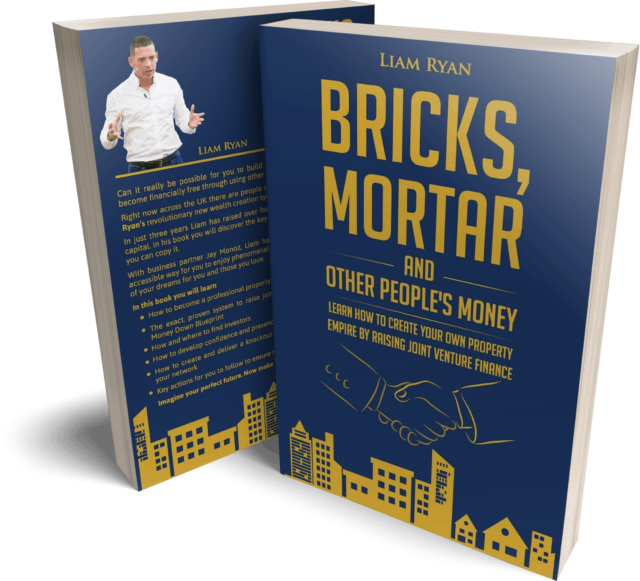

Claim Your Free Copy

Assets For Life LTD is a company incorporated in England and Wales with registered number 09935286 and registered offices at Assets for Life Ltd, Suite 105, Waterhouse Business Centre, 2 Cromar Way, Chelmsford, Essex, England, CM1 2QE, United Kingdom.

Assets For Life LTD is registered with the Information Commissioner’s Office, with registration number ZA280607

COPYRIGHT © 2024 ASSETS FOR LIFE, ALL RIGHTS RESERVED. WEBSITE BY AMPLIFY MARKETING