Are you interested in investment property in London? This guide will tell you everything you need to know to get started, from insider tips and advice to different kinds of investment strategies, and things to watch out for. Our guide is broken down into several sections, including:

- Why invest in Properties in London?

- Understanding the London Property Market

- How to find Investment Properties in London

- Benefits and Risks to London Property Investment

- How to make money by investing in London Property

Why invest in Properties in London?

With its global appeal and enduring value, London continues to be a popular choice for investors seeking lucrative opportunities in the real estate market.

Stability

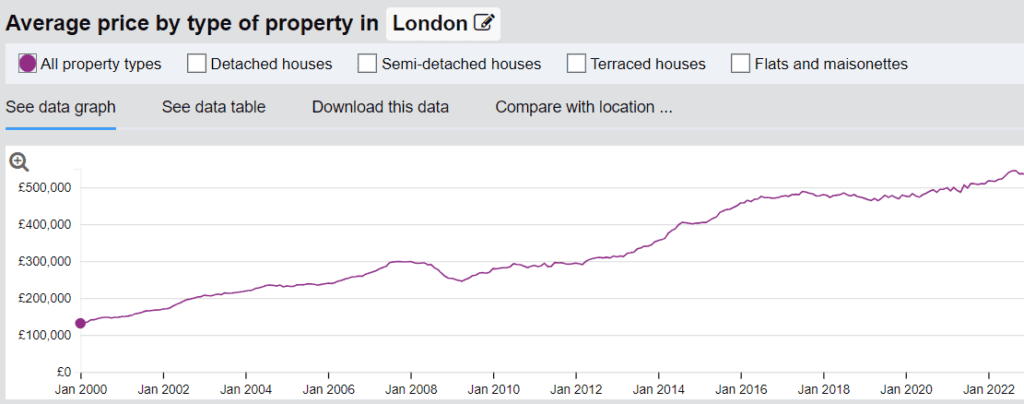

Despite occasional fluctuations, property prices in the city have shown consistent growth over the years. This trend is driven by strong demand from both local residents and international investors, ensuring a reliable return on investment. Additionally, London’s property market has proven to be a safe haven for capital preservation, making it an appealing choice for those seeking long-term financial security.

The chart below from the UK Land Registry shows how London property prices have consistently risen over the past 20 years and fluctuations in price remain minimal.

High Rental Values

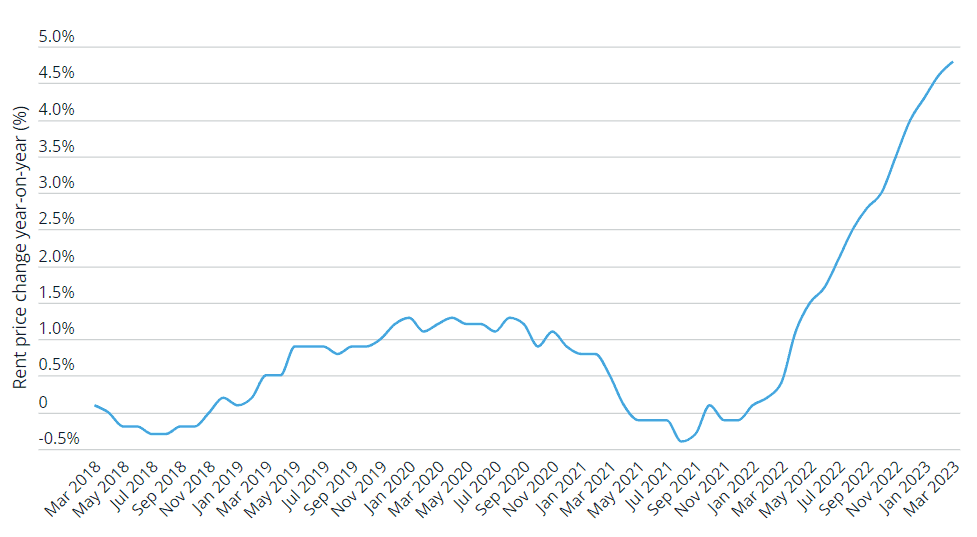

Another significant advantage of investing in London properties is the city’s thriving rental market. As a global hub for business, finance, and education, London attracts a constant influx of professionals, students, and tourists. This high demand for rental properties translates into attractive rental yields, enabling investors to generate regular income streams. Moreover, London’s reputation as a cultural and economic powerhouse ensures a steady stream of potential tenants, reducing the risk of property vacancies.

Renting a property in London continues to be in high demand – in fact, rental prices have risen in recent years and the average monthly rent in London is now £2,500. The chart below from the Office for National Statistics shows how rental values in London have risen dramatically just since 2021.

Location

Location, location, location is still true – London is and has always been the place for young professionals, new businesses, and other growth markets., with its unparalleled array of world-class amenities, including renowned educational institutions, prestigious shopping districts, iconic landmarks, and a thriving arts and culture scene. From historic neighbourhoods to trendy urban areas, London offers diverse choices for residents and investors alike, ensuring a high quality of life. This undeniable social cache, in addition to London’s strategic location and excellent transport links, makes it a top choice for property investment.

The city boasts access to several international airports, enabling easy connections to major global destinations. Additionally, London’s efficient public transportation system, including the world-famous London Underground, provides residents with seamless connectivity to various parts of the city. Such accessibility enhances the desirability of properties in London and contributes to their long-term value appreciation.

Understanding the London Property Investment Market

Before you take the leap into property investment in London, you should learn all about the ins and outs of the London property market. Take the time to familiarise yourself with the current state of the market, including market trends, average house prices, and potential risks.

Market Analysis

Consider consulting market analysis reports and real estate research consultancies for up-to-date, reliable information. London has long been considered a safe haven in the property market, but it’s essential to be aware of recent fluctuations in house prices and predictions for future changes. The average house prices in London, while mostly stable, have experienced fluctuations, so it’s crucial to understand and analyse these trends before making any investment decisions and proceeding in your journey to property investment in London.

Housing Market Report

The latest London housing market report published in May 2023 by data.london.gov.uk indicates that while property and rental prices remain high, the rate of growth has slowed for both markets. However, demand remains high for London rentals, although the market is slowly stabilising. There has been less house building and less completed sales on properties, this is likely due to the end of the Help to Buy scheme and higher borrowing costs. These stats aren’t something to be afraid of when considering property investment in London – just something to bear in mind and potentially leverage to your advantage.

How to find Investment Properties in London

Finding the right investment properties requires a strategic approach and thorough research. Here are some key steps to help you navigate the process of finding investment properties in London.

Define your investment goals

You should begin by clarifying your investment objectives. Decide whether you are looking for properties to generate rental income or properties with the potential for capital appreciation. This will help you in your search for suitable properties and make informed decisions in your journey to property investment in London.

Build up useful connections

Cultivate relationships with experienced estate agents who specialise in the London property market. They can provide you with valuable insights, assist with finding the right properties for you, and negotiate deals on your behalf. Also, connect with property wholesalers who specialise in finding discounted properties that may not be listed on traditional platforms. They could help you find hidden gems that others will miss out on.

Know where to look

Make use of online platforms, property websites, and real estate portals to search for investment properties in London. These platforms allow you to filter your search based on criteria such as price range, property type, and location. Additionally, you can access property listings, view photographs, and gather valuable information about the properties.

Do your research

Take an in-depth look at potential areas in London for property investment. Here is a short list of areas with great potential, although it is always recommended to do your own research before investing.

Kensington and Chelsea: Houses in this district in Central London sold for an average of £2,542,831 in the last 12 months. This area is one of the most affluent and sought-after in London, and it’s easy to see why, with its stunning architecture, world-class amenities, and unshakable reputation. This area offers great potential for high rental yields and strong capital growth.

Up-and-coming areas: DA18 Belvedere, RM7 Romford, RM9 Dagenham, E11 Wanstead, and SM5 Carshalton are identified as London’s five hottest property markets by market analysts Propcast, as reported by London’s Evening Standard. These areas, all outside of Zone 1, might not be what first springs to mind when you think of popular property investment, but they are undergoing redevelopment works and can offer some great opportunities for investors.

Acton: Located in West London, Acton might not be an especially well-known area of London, but it has experienced a 21% growth in property value over the past 3 years due to multi-million-pound regeneration projects, updated transport links, and trendy apartment blocks. This makes it a promising area for property investment.

Ilford, Romford, Barking, Dagenham, and Harlington: These areas are further away from central London and tend to be less expensive to invest in than other London Boroughs, but could be lucrative for property investment due to their high demand levels, decent yields, and high rental income.

Benefits and Risks to London Property Investment

There are plenty of benefits to investing in property in London, including the aforementioned history of stable property price growth, attractive rental yields, strong demand for rental properties and its global reputation as a cultural, educational, and economic hub. But there are also risks to London property investment that should not be ignored.

High cost of entry

London property prices can be quite a bit higher compared to other regions in the UK, so the initial investment required to purchase properties in London can be substantial, limiting entry for some investors. Take a serious look at how much you have to invest and decide if London property investment is really for you.

Regional variations

London is a pretty big city with huge variations in property values and rental yields across different boroughs and neighbourhoods. You can’t expect to get the same return on investment from a property in Croydon as you can in Kensington! Before investing, you need to carefully assess each area to ensure the location you choose aligns with your investment objectives.

Legal considerations

There are a lot of laws and regulations surrounding investment property in London and the UK in general. Take the time to familiarise yourself with landlord responsibilities, tenant’s rights, property taxes, planning regulations, and other legal and regulatory requirements so you don’t get any nasty surprises further down the line. Property investments in London are also subject to various tax regulations, including income tax on rental income, capital gains tax on property sales, and inheritance tax. Consult with a legal professional before committing to an investment to make sure you are up to date on all legal requirements.

How to make money by investing in London Property

Decide on an action

Firstly, decide what you want to do. You could buy properties with the long-term plan of selling them when they appreciate in value if current trends continue. You could invest in a run-down property and do some refurbishment, and sell for a high price. You could also invest in property and make your money back by renting to tenants, whether those are residential or commercial renters. Making a detailed plan before taking action helps to ensure you keep on track, and don’t make impulsive decisions.

Set a budget – and stick to it

It’s easy to get carried away with investment opportunities, and before you know it, your entire budget has been spent. There are also a lot of potential costs that you might not expect, so set aside a contingency budget for any emergencies. Bear in mind that property investment in London like any other form of property investment is a long-term game and you might have to wait at least a little while before seeing a real return on your investment. Stay the course and be patient – it will pay off in the end.

Do your homework

Make sure you do plenty of research! It’s a fool’s game to throw money into a market you don’t really understand, so take the time to learn everything about the London property market before investing – visit areas multiple times and seek advice from professionals in the same field. Research is ongoing too – the London property investment market constantly evolves and changes, and you need to keep abreast of these changes to be successful.

Adopt a growth mindset

Having the right mindset is key to any kind of success. Of course, hard work is important too, but fostering a good attitude and positive mindset will help you to navigate challenges, embrace opportunities, and ultimately achieve success in the property investment industry. Don’t get deterred by potential setbacks or failures – be willing to step outside your comfort zone in your London property investment journey and explore innovative investment approaches. There will be setbacks, to be sure, but they are part of the learning process and you can use them as lessons rather than reasons to quit.